Welcome to Financial News Page from Financial Management – IFA

Over the past 12 months we have seen a marked increase in the use of Equity Release funds for supplementing retirement income.

It doesn’t feel like the cost of living is slowing down and individuals want and expect more out of retirement and are active for much longer as each new generation moves into this phase of their lives. The new (ish) pensions freedom legislation isn’t necessarily delivering for all, as stock market returns frequently disappoint and leave individuals short on their regular income. People want to travel and socialise more, to keep driving for longer and in better cars.

There has been a noticeable rise in the number of retirement mortgages on offer from lenders – mainstream and specialised alike – however the income of the majority of individuals in retirement cannot match up to the stringent affordability test required by these lenders. Many homeowners, therefore, who are coming to the end of an interest only mortgage, on the receiving end of frequent letters from their mortgage provider demanding to know their plan to repay their mortgage, are turning to Equity Release. This solution allows people to stay in their homes with the flexibility to choose whether they pay the interest or not.

Equity Release continues to be a popular option for those wanting to gift an advanced inheritance and/or help children and grandchildren onto the housing ladder with ‘intergenerational fairness’ in mind.

Equity Release continues to be a popular option for those wanting to gift an advanced inheritance and/or help children and grandchildren onto the housing ladder with ‘intergenerational fairness’ in mind.

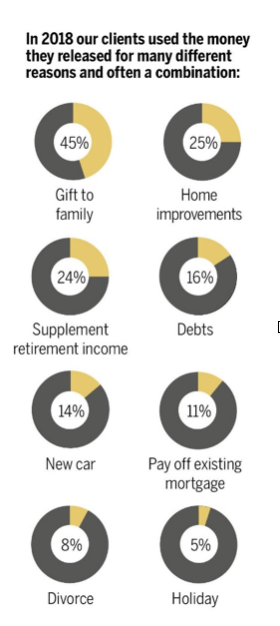

Here is a full breakdown for how our clients used the money released via Equity Release in 2018. Most borrowers used the cash for more than 1 purpose.

Vanessa Carver

Equity Release Adviser

Equity Release Adviser

Contact us: 01494 817151

Penn Barn, Elm Road, Penn, Bucks HP10 8LB